Trust Foundations: Dependable Solutions for Your Building

Trust Foundations: Dependable Solutions for Your Building

Blog Article

Reinforce Your Legacy With Professional Count On Foundation Solutions

In the realm of heritage planning, the importance of establishing a strong foundation can not be overemphasized. Expert trust fund structure services offer a robust framework that can guard your possessions and ensure your desires are accomplished exactly as meant. From lessening tax obligation responsibilities to selecting a trustee who can effectively manage your events, there are crucial considerations that demand attention. The complexities associated with trust structures necessitate a critical strategy that aligns with your long-lasting objectives and worths (trust foundations). As we look into the nuances of trust foundation remedies, we reveal the crucial elements that can strengthen your legacy and give a lasting impact for generations to come.

Advantages of Trust Fund Foundation Solutions

Count on structure remedies provide a robust structure for securing possessions and making sure long-term monetary safety and security for people and organizations alike. One of the primary benefits of trust fund structure solutions is possession security.

With depends on, people can detail just how their assets ought to be handled and distributed upon their passing. Trusts additionally provide privacy advantages, as properties held within a trust are not subject to probate, which is a public and commonly prolonged lawful process.

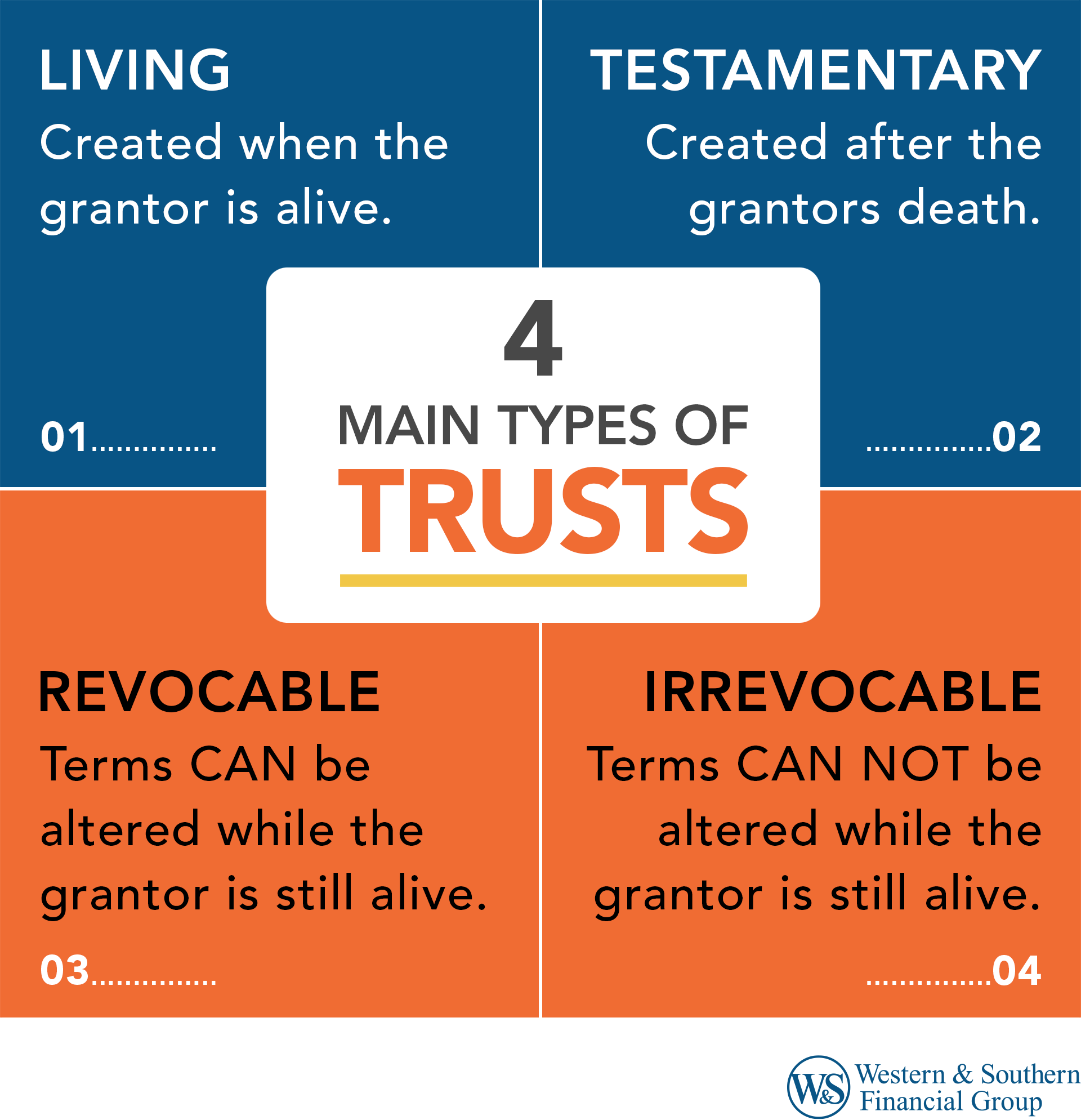

Kinds of Counts On for Legacy Preparation

When thinking about tradition planning, a vital element involves checking out different sorts of lawful instruments made to protect and disperse possessions effectively. One typical kind of trust fund used in tradition preparation is a revocable living count on. This trust allows individuals to maintain control over their properties throughout their lifetime while guaranteeing a smooth shift of these assets to recipients upon their death, staying clear of the probate procedure and providing personal privacy to the household.

Charitable trust funds are additionally preferred for people looking to sustain a reason while preserving a stream of income for themselves or their beneficiaries. Special requirements counts on are crucial for people with disabilities to ensure they obtain needed treatment and assistance without jeopardizing federal government benefits.

Recognizing the different kinds of depends on readily available for legacy preparation is crucial in establishing a detailed technique that straightens with individual objectives and top priorities.

Selecting the Right Trustee

In the realm of tradition preparation, an essential aspect that demands careful factor to consider is the selection of an appropriate individual to satisfy the critical role of trustee. Picking the right trustee is a choice that can significantly influence the successful execution of a depend on and the satisfaction of the grantor's dreams. When picking a trustee, it is vital check my blog to focus on top qualities such as reliability, economic acumen, integrity, and a dedication to acting in the very best interests of the recipients.

Ideally, the chosen trustee needs to have a solid understanding of financial matters, be capable of making audio investment choices, and have the ability to navigate complex legal and tax obligation requirements. By carefully taking into consideration these aspects like this and choosing a trustee that straightens with the worths and goals of the depend on, you can aid make certain the long-lasting success and preservation of your tradition.

Tax Ramifications and Benefits

Considering the fiscal landscape bordering trust fund structures and estate planning, it is extremely important to dig right into the intricate realm of tax obligation ramifications and benefits - trust foundations. When establishing a depend on, comprehending the tax obligation ramifications is essential for enhancing the benefits and decreasing possible responsibilities. Trust funds supply different tax benefits relying on their framework and objective, such as lowering estate taxes, earnings tax obligations, and gift taxes

One substantial benefit of specific trust fund frameworks is the ability to move properties to recipients with decreased tax effects. For instance, unalterable trust funds can eliminate possessions from the grantor's estate, possibly decreasing inheritance tax liability. In addition, some trust funds enable for revenue to be distributed to beneficiaries, that might be in reduced tax braces, leading to general tax savings for the family members.

Nonetheless, it is crucial her latest blog to note that tax regulations are complicated and subject to change, stressing the requirement of talking to tax obligation professionals and estate preparation specialists to guarantee compliance and optimize the tax advantages of trust structures. Correctly browsing the tax obligation effects of counts on can bring about substantial cost savings and a much more effective transfer of riches to future generations.

Actions to Establishing a Depend On

The first action in developing a trust is to clearly define the function of the trust and the properties that will be included. Next off, it is essential to select the type of trust fund that ideal aligns with your objectives, whether it be a revocable depend on, unalterable trust, or living depend on.

Final Thought

To conclude, developing a depend on foundation can give numerous advantages for heritage planning, consisting of asset protection, control over distribution, and tax advantages. By picking the suitable kind of count on and trustee, individuals can safeguard their possessions and ensure their desires are brought out according to their needs. Recognizing the tax implications and taking the essential steps to establish a trust fund can aid enhance your tradition for future generations.

Report this page